ABOUT :-

Sumitomo Chemical India Ltd. (SCIL) (CIN: L24110MH2000PLC124224) manufactures, imports and markets products for Crop Protection, Grain Fumigation, Rodent Control, Bio Pesticides, Environmental Health, Professional Pest control and Feed Additives for use in India. SCIL has also marked its presence in Africa and several other geographies of the world.

सुमितोमो केमिकल इंडिया लिमिटेड (एससीआईएल) (सीआईएन: एल24110एमएच2000पीएलसी124224) भारत में उपयोग के लिए फसल सुरक्षा, अनाज धूमन, कृंतक नियंत्रण, जैव कीटनाशकों, पर्यावरणीय स्वास्थ्य, व्यावसायिक कीट नियंत्रण और फ़ीड एडिटिव्स के लिए उत्पादों का निर्माण, आयात और विपणन करता है। SCIL ने अफ्रीका और दुनिया के कई अन्य भौगोलिक क्षेत्रों में भी अपनी उपस्थिति दर्ज कराई है।

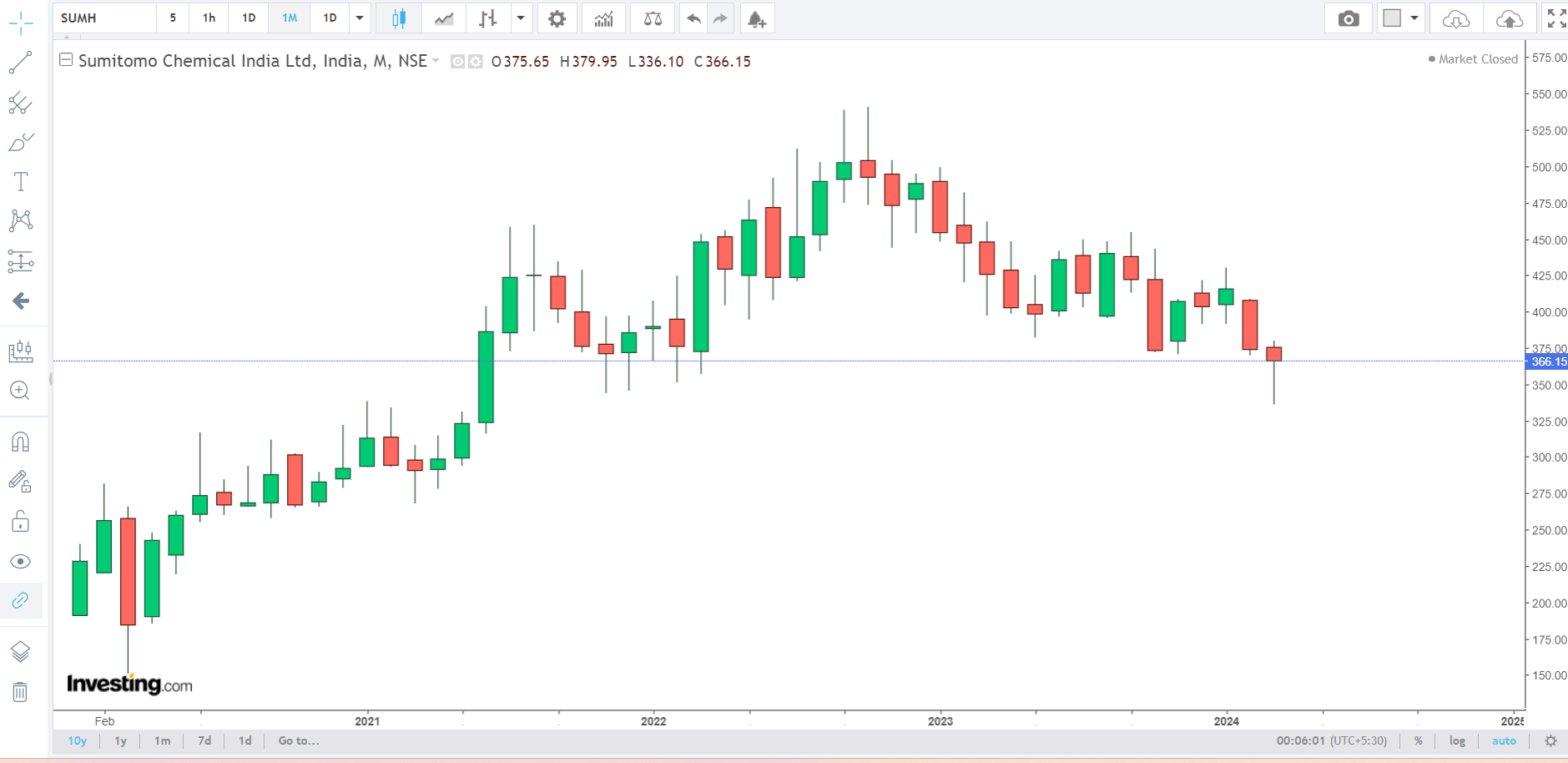

- Market Cap ₹ 18,276 Cr.

- Current Price ₹ 366

- High / Low ₹ 455 / 336

- Stock P/E 54.9

- Book Value ₹ 50.6

- Dividend Yield 0.33 %

- ROCE 30.2 %

- ROE 23.4 %

- Face Value ₹ 10.0

| Stock Price CAGR | |

|---|---|

| 10 Years: | % |

| 5 Years: | % |

| 3 Years: | 11% |

| 1 Year: | -13% |

Quarterly Results

Standalone Figures in Rs. Crores / View Consolidated

| Dec 2020 | Mar 2021 | Jun 2021 | Sep 2021 | Dec 2021 | Mar 2022 | Jun 2022 | Sep 2022 | Dec 2022 | Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 560 | 534 | 782 | 910 | 707 | 664 | 986 | 1,122 | 753 | 652 | 724 | 903 | 540 | |

| 482 | 463 | 631 | 695 | 580 | 555 | 798 | 843 | 632 | 571 | 643 | 715 | 475 | |

| Operating Profit | 78 | 71 | 150 | 215 | 127 | 109 | 188 | 278 | 121 | 81 | 81 | 188 | 66 |

| OPM % | 14% | 13% | 19% | 24% | 18% | 16% | 19% | 25% | 16% | 12% | 11% | 21% | 12% |

| 6 | 5 | 5 | 8 | 15 | 7 | 5 | 11 | 13 | 17 | 18 | 25 | 27 | |

| Interest | 1 | 1 | 2 | 2 | 2 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Depreciation | 11 | 13 | 11 | 11 | 11 | 11 | 11 | 15 | 11 | 14 | 14 | 16 | 16 |

| Profit before tax | 71 | 61 | 143 | 210 | 129 | 104 | 180 | 272 | 121 | 82 | 83 | 196 | 76 |

| Tax % | 24% | 12% | 26% | 26% | 24% | 28% | 23% | 26% | 25% | 12% | 26% | 27% | 27% |

| 54 | 54 | 106 | 155 | 98 | 75 | 138 | 202 | 91 | 72 | 62 | 144 | 55 | |

| EPS in Rs | 1.09 | 1.09 | 2.13 | 3.11 | 1.96 | 1.50 | 2.77 | 4.05 | 1.82 | 1.45 | 1.24 | 2.88 | 1.10 |

Profit & Loss

Standalone Figures in Rs. Crores / View Consolidated

| Mar 2012 | Mar 2013 | Mar 2014 | Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | TTM | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 451 | 495 | 635 | 671 | 724 | 799 | 1,911 | 2,223 | 2,423 | 2,643 | 3,060 | 3,511 | 2,820 | |

| 463 | 484 | 587 | 614 | 635 | 698 | 1,691 | 1,932 | 2,088 | 2,155 | 2,458 | 2,843 | 2,404 | |

| Operating Profit | -12 | 10 | 48 | 57 | 89 | 101 | 219 | 291 | 335 | 488 | 603 | 668 | 416 |

| OPM % | -3% | 2% | 8% | 8% | 12% | 13% | 11% | 13% | 14% | 18% | 20% | 19% | 15% |

| 1 | 3 | 3 | 8 | 26 | 10 | 31 | -0 | -20 | 19 | 36 | 45 | 86 | |

| Interest | 0 | 0 | 2 | 1 | 1 | 1 | 5 | 5 | 7 | 7 | 8 | 6 | 5 |

| Depreciation | 0 | 0 | 6 | 6 | 7 | 7 | 24 | 28 | 41 | 47 | 45 | 52 | 59 |

| Profit before tax | -11 | 13 | 43 | 58 | 107 | 103 | 221 | 258 | 267 | 453 | 586 | 655 | 437 |

| Tax % | 0% | 0% | 23% | 40% | 40% | 40% | 34% | 35% | 23% | 24% | 26% | 23% | |

| -11 | 13 | 33 | 35 | 65 | 62 | 145 | 167 | 206 | 345 | 434 | 503 | 333 | |

| EPS in Rs | 4.12 | 6.92 | 8.69 | 10.09 | 6.67 | ||||||||

| Dividend Payout % | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 38% | 18% | 12% | 12% | 12% |

Balance Sheet

Standalone Figures in Rs. Crores / View Consolidated

| Mar 2012 | Mar 2013 | Mar 2014 | Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Sep 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Equity Capital | 233 | 233 | 233 | 233 | 233 | 275 | 275 | 275 | 499 | 499 | 499 | 499 | 499 |

| Reserves | -82 | -70 | -36 | -2 | 63 | 360 | 665 | 761 | 710 | 1,029 | 1,425 | 1,881 | 2,025 |

| 0 | 1 | 0 | 0 | 0 | 0 | 10 | 20 | 36 | 33 | 38 | 34 | 29 | |

| 208 | 202 | 243 | 234 | 280 | 288 | 695 | 791 | 848 | 1,097 | 1,047 | 955 | 974 | |

| Total Liabilities | 359 | 367 | 440 | 466 | 576 | 922 | 1,644 | 1,846 | 2,093 | 2,658 | 3,009 | 3,369 | 3,528 |

| 53 | 48 | 47 | 51 | 52 | 53 | 267 | 279 | 319 | 309 | 390 | 430 | 501 | |

| CWIP | 0 | 0 | 0 | 0 | 1 | 7 | 9 | 8 | 10 | 14 | 35 | 71 | 23 |

| Investments | 0 | 0 | 0 | 0 | 0 | 277 | 2 | 1 | 87 | 291 | 357 | 239 | 587 |

| 306 | 319 | 393 | 415 | 523 | 585 | 1,367 | 1,558 | 1,676 | 2,043 | 2,227 | 2,628 | 2,416 | |

| Total Assets | 359 | 367 | 440 | 466 | 576 | 922 | 1,644 | 1,846 | 2,093 | 2,658 | 3,009 | 3,369 | 3,528 |

Shareholding Pattern

Numbers in percentages

| Mar 2021 | Jun 2021 | Sep 2021 | Dec 2021 | Mar 2022 | Jun 2022 | Sep 2022 | Dec 2022 | Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | |

| 1.12% | 1.22% | 1.32% | 1.36% | 1.69% | 1.90% | 2.05% | 2.44% | 2.40% | 2.51% | 2.58% | 2.61% | |

| 6.29% | 6.57% | 6.13% | 6.17% | 6.36% | 6.70% | 6.39% | 5.52% | 5.50% | 5.50% | 6.06% | 6.02% | |

| 17.59% | 17.21% | 17.55% | 17.47% | 16.95% | 16.40% | 16.54% | 17.02% | 17.09% | 16.96% | 16.33% | 16.35% | |

| No. of Shareholders | 73,327 | 78,651 | 1,19,561 | 1,50,589 | 1,39,601 | 1,33,658 | 1,46,063 | 1,44,018 | 1,42,596 | 1,56,136 | 1,47,907 | 1,45,083 |